While it is easier than ever to sell products globally, the move to go international isn’t without its complications. Figuring out logistics, taxes, translation, not to mention targeting and marketing to a new customer base all takes a lot of time and effort.

But once you have figured it all out and are selling in the U.K., Europe, maybe even Asia, you want to make sure you are making as much as possible, getting the highest ROI (return on investment) for your hard work.

However, there is one element of global sales that can have a tremendous impact on your bottom line that has very little (if anything) to do with your business -- currency. When you sell in the U.K., you are earning British pounds (GBP), but if you are based in the US then you need to convert your GBP to USD.

Understanding Exchange Rate Fluctuations

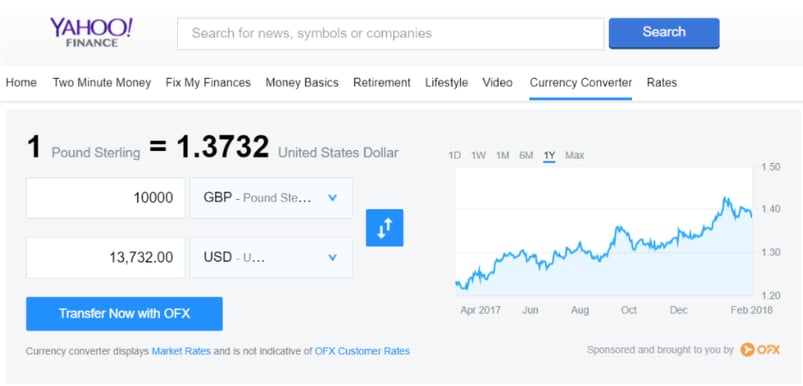

Let’s say you made 10,000 GBP worth of sales in the month of January, how much is that in USD? It all depends on when you convert the GBP to USD. If you converted it on February 1st then your 10,000 pounds were worth $14,199 USD. If you waited until February 28th, you would get $13,727. That’s over $400 in additional profit (or loss) due solely to exchange rate fluctuations.

Now you may be saying that $400 isn’t that much, but what happens when we expand our timeframe? Let’s say you had revenues of 10,000 GBP in February of last year. That only got you $12,377, that’s almost $1,500 less than this year for the exact same amount of sales.

Over the past year, the GBP to USD exchange rate has had a low of 1.2046 and a high of 1.425. that’s over a 15% swing in value that directly affects your bottom line and can take you from a profitable month to losing money in the blink of an eye. So what can you do about it?

How to Reduce Exchange Rate Risks

International sellers have two options on how to deal with exchange rate issues.

Option 1. Do nothing – aka the ostrich approach

Some sellers think that exchange rates are too complicated, too hard to manage, or they simply don’t have the time. So they choose to stick their head in the sand, pretend currency fluctuations don’t

Disclaimer: this approach is not recommended.

Option 2. Actively Monitor Exchange Rates and Decide Accordingly

While no one knows exactly how currencies are going to move relative to one another, there are a few things you can do to minimize the

- Stay on top of currency fluctuations.

- Either with a bank or a currency company, you set alerts for yourself, should a currency pair hit a certain threshold. Let’s say you are selling an item for $130 USD and your cost is $80 USD. You decide to sell in the UK at an equivalent price of 100 GBP and want to keep the same a margin to cover marketing and other expenses. This means if the GBP / USD exchange rate drops below 1.3, then you will be making less per unit sold in the UK than you are in the US. You set an alert just in case the rate drops that low so you can decide to either take a slimmer margin, adjust your sales price, or set a forward contract (more on that below).

- Set a forward contract to lock in your exchange rate.

- At any time, you can call a bank or currency company to lock in an exchange rate. You decide the amount of the contract, which will depend on your estimated future sales. If you forecast you will be converting 500,000 GBP into USD over the next 12 months, you can choose a contract for all 500,000 or some fraction of that amount. The higher your risk appetite the less you might want to lock in. Of course, while a forward rate limits your downside risk, it also limits your upside potential. If the GBP to USD exchange rate goes from 1.33 to 1.65, you will still only be getting 1.33 USD for every pound rather than 1.65.

- Avoid converting currencies if you don’t have to.

- Any currency conversion, no matter what the exchange rate, comes with its own cost. Banks typically include a margin of between 2-4%, and marketplaces are known to be higher than that. If you have GBP sales and need to pay vendors in GBP, don’t convert your currency twice. Not only will you be getting a different exchange rate (for better or for worse) but the margins you have to pay for the conversion will eat into your margins.

Bottom line, selling globally is great and offers a huge opportunity for brands large and small to increase revenues. However, there is added complexity that you need to manage for in order to make sure you are earning the most profit possible.