Chances are you didn’t start your online business because you were super excited to fill out long and detailed government forms. But collecting and filing sales tax is a necessary administrative hassle for online sellers. Fortunately, once you’ve mastered sales tax, it becomes less of a mystery, and more like just another check on your to do list.

This list details seven things you may not have known about sales tax, and how understanding these facts will make your sales tax life a whole lot easier!

1. Sales tax is governed at the state, not federal, level

This can be one of the most difficult things for online sellers to wrap their heads around. There is no “federal” sales tax in the U.S., and the IRS has nothing to do with sales tax.

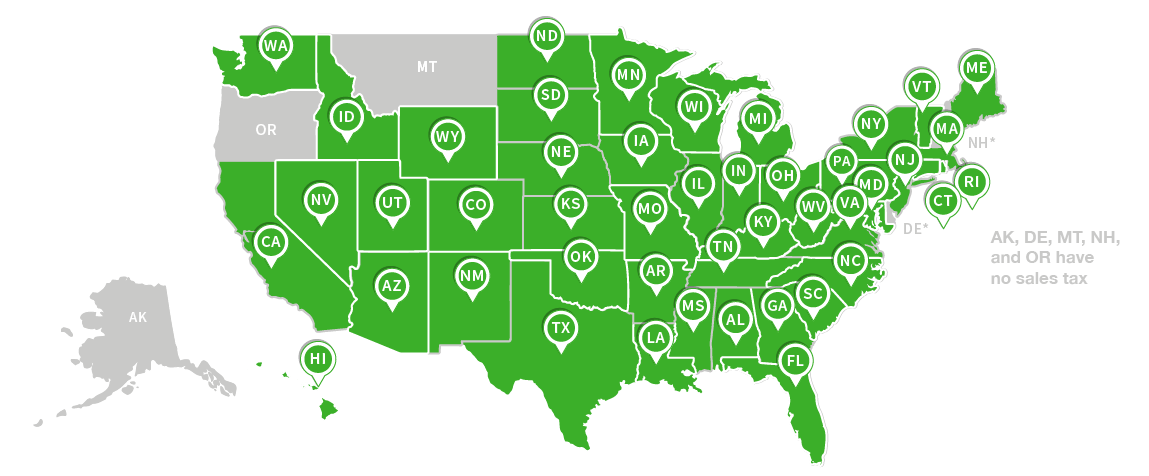

Instead, sales tax is governed at the state level. Forty-five states and Washington D.C. all have a sales tax. This means they each have their own sales tax rules, laws and regulations when it comes to how they want online sellers to do things. This means sales tax rates, sales tax due dates and how detailed sales tax reports have to be will differ from state to state.

2. You are only required to collect sales tax in states where you have “nexus” (for now)

We talk to a lot of online sellers who ask if they should collect sales tax from every single buyer. The good news is that, as of right now, in the U.S. you are only required to collect sales tax from buyers in states where you have “sales tax nexus.”

Sales tax nexus is just a legalese way to say a “significant connection” to a state. You always have sales tax nexus in your home state. So, for example, if you are based in California then you are required to collect sales tax from buyers in California.

But some factors can create nexus for your business in other states. You may have nexus in another state if your business does any of the following in that state:

- Has an office, store, warehouse or other location

- Has an employee, contractor, sales person or other personnel

- Has a 3rd party affiliate

- Stores inventory for sale in a warehouse (such as through Amazon FBA or another 3rd party fulfillment service)

- Makes temporary sales tax a trade show, festival or craft fair

You can read what each state’s sales tax laws say about sales tax nexus for online sellers here. When in doubt, we recommend contacting a vetted sales tax expert.

3. Always register for a sales tax permit before collecting sales tax

Once you’ve determined you are required to collect sales tax from buyers in a state, your next step is to register for a sales tax permit with the state’s taxing authority.

You can register for a sales tax permit with your state’s taxing authority. This is generally called the “[State] Department of Revenue” but it may go by another name.

Don’t start collecting sales tax until you have a sales tax permit! Most states consider it illegal to collect sales tax without a permit.

4. How often you file sales tax depends on your state and your sales volume

If you register for a sales tax permit online via your state’s taxing system, you’ll receive it anywhere from instantaneously to several weeks ago. And when you receive your permit, you’ll also receive instructions on how often to file a sales tax return and your sales tax filing due dates.

How often you are required to file sales tax usually depends on your sales volume. High volume sellers are generally required to file quarterly, while lower volume sellers may be asked to file monthly or annually.

The date of the month your sales tax return is done on varies, too. In most states, sales tax is due on the 20th of the month following the taxable period. But some states want you to file by the final day of the month, the 15th, the 25th, or some other date.

5. You’re often rewarded for filing sales tax on time (and penalized for being late)

Be sure to note down the dates and filing frequencies at which your sales tax returns are due. Don’t be late filing!

If you are late, most states assess penalties (usually around $50 per filing) and interest which compounds daily on the past due amount. Ouch!

Plus, some states allow on-time filers to keep a small percentage of the sales tax you collected. While this percentage is generally only 1-2% of the sales tax you’ve collected, it’s free money! Here’s a list of states with sales tax discounts for on-time filers.

6. Filling out tax forms is the hardest part of sales tax

States and local areas within states (cities, counties, etc.) rely on funds from sales tax to pay for budget items like schools, roads and public safety. Because of this, most states require that only sellers divide up how much sales tax you’ve collected based on your in-state buyers’ locations. This can mean that you end up filling out dozens or even hundreds of line items on a sales tax filing form. It’s tedious, nitpicky work and getting the numbers wrong in even one line can mess up your entire return. Yikes!

That’s where sales tax automation comes in. With technology, you can connect the online shopping carts and marketplaces on which you sell and receive a return-ready sales tax report with all your sales broken down just like the state wants to see it. You can even AutoFile your sales tax returns if you never want to deal with the hassle of filing another sales tax return. Filling out sales tax filings is tough and time-consuming, but technology can make it simple.

7. We’re living in a sales tax Wild West

Sales tax laws are changing all the time. With the rise of eCommerce, many states have begun to claim that they are not getting their fair share of sales tax. Some states have passed laws designed to force out-of-state sellers to comply with their sales tax laws. An internet sales tax-related case is actually going all the way up to the Supreme Court this spring. Internet sales tax could change drastically in the coming months, so keep an eye on the news for what you need to know.