When you decided to start an online business, you likely thought you'd avoid many of the issues faced by brick-and-mortar stores. When it comes to collecting sales tax for online retailers, though, you’re in the same boat as other business owners. Of course, there are variations in how you’d calculate sales tax for eCommerce. Luckily, this handy guide can help you out!

Sales Tax for Sellers

While you may get away with selling on Craigslist and not charging sales tax, this won’t fly if you’re running a legitimate online retail business. There are a variety of situations where you’ll have to charge sales tax in online stores, but there are also some states don't collect it at all. Understanding the nexus and varying laws will help you pinpoint when collecting taxes is required.

While a sales tax nexus might sound like a complicated legal term, it’s really quite simple. It's simply another way to say that your business has a significant presence in a certain state. This typically means a physical presence - such as a brick-and-mortar store, warehouse or office - but you should also note that having employees in a certain state could also establish a "significant presence" under law.

The point to remember is that every state has its own definition of what constitutes a nexus. Having an actual physical presence, such as a warehouse or office, will certainly establish a sales tax nexus. It's important to note, though, that other states' requirements are much more lax.

When You Have to Collect Sales Tax Online

Your state's sales tax nexus usually isn't all you have to worry about. The city, county or other government entity that you work in may have their own taxes. This is where this particular tax for online retailers can get complicated. You’ll need to know the sales tax requirements for every government - whether local or state - in a certain jurisdiction.

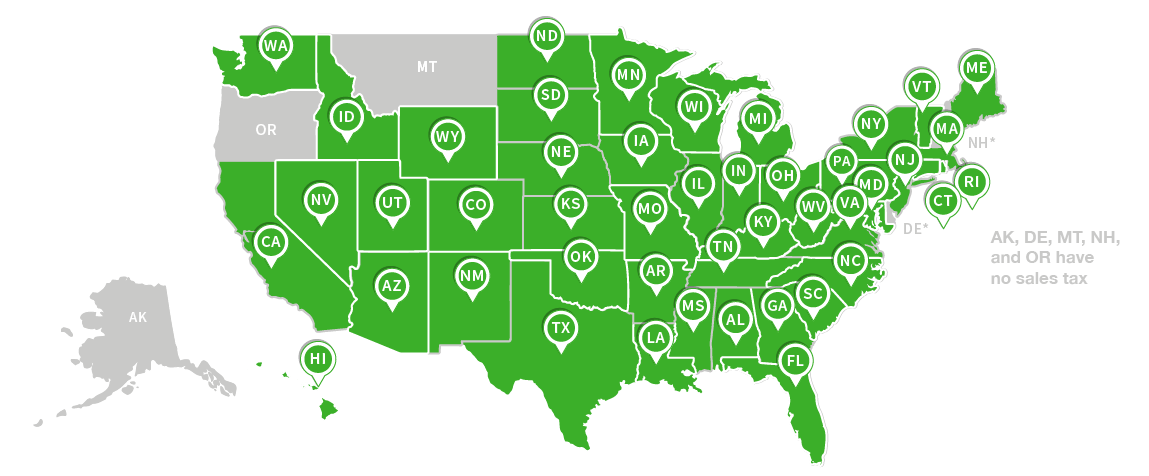

There are also 45 states that collect sales tax for eCommerce, so if you’re selling to one of their citizens, things might get even more complicated.

eCommerce Across State Borders

Just because most of your business property is in one state doesn’t prevent an out-of-state sales tax nexus from existing. If you have employees or inventory in a certain state, you’ll typically need to collect sales tax. Here are a few other instances when it is usually required:

- Temporary nexus (such as tradeshows)

- Drop shippers in a state

- Advertisers in a state

- Physical locations of any kind

It’s also important to note that many states have special taxes for online retailer requirements. Arizona, for instance, will require tax collection if your customer uses their own vehicle to pick up a product. If you have Pennsylvania customers, however, you don’t have to collect any tax if they’re purchasing clothes. The following five states are the only ones you don’t have to worry about collecting tax for:

- Alaska

- Delaware

- Montana

- New Hampshire

- Oregon

If you sell to customers in any other state, you’ll want to verify whether you have a sales tax nexus with that state.

Filing Sales Tax Returns

Looking up the sales tax nexus rules for each state can be time-consuming, but filing returns can be downright tiresome. Once again, every state has its own rules, and some states will even want documentation of your taxing even outside of their jurisdiction.

As a business owner, filing sales tax returns in multiple states can seriously cut into the time you should be focusing on your business. Fortunately, there are a few tools that can help.

Sales Tax Reporting and Filing Tools

Fortunately, you can visit most states’ department of revenue pages and they’ll provide information on what qualifies as a sales tax nexus. Many even have forms you can submit online without having to file volumes of paperwork.

To go further, there are also comprehensive ecommerce management systems that can make your life easier with automation tools.

As an all-in-one solution, Jazva supports sales tax calculated from marketplaces and shopping carts, and the rates can be set up automatically or manually. Automatic rates are based on Avalara's real-time tax rates, but Jazva users can set their own custom rate rules if needed.

Tax rates can be flexible as needed. They are line item based, so tax rates are not calculated based on the overall order but for each line item in the order. This means, you can have an order with 5 items and only 1 of the items can be taxable. You can even define your rate by zip code, range, rate percent, and even if it should be applied to shipping, product, or customer tax classes.

Finally, Jazva is partnered with Avalara, so if you need more help with tax compliance, we'll be happy to refer you to the best tax experts!

Read Now: Learn how to Growth Hack Your Business Through Multi-Channel Selling