The end of the holiday season is a great time for eCommerce market and sales analysts to go over trends in customer buying and spending behaviors, and the patterns that defined those behaviors.

To begin with, let’s look at some statistics for 2017 holiday eCommerce spending:

- As Deloitte predicted, the weeks leading up to Black Friday/late November and late December accounted for up to 80% of retail sales in the holiday season, with online retail shopping emerging the clear winner in sales contributions.

- The National Retail Federation revealed last week that retail sales outperformed last year's numbers by over 5.5%, with revenue from online sales and non-store sales shot to $138.4 billion, seeing an 11.5% rise over last year's numbers.

- According to Adobe Insights, 2017 is the first year where holiday sales have surpassed the $100 billion mark in digital transactions alone.

- The number of in-store shoppers dropped by 3 million to 99 million from last year, while online shoppers increased to 108 million, a 5 million increase from last year.

So, What Behavioral Trends Account for Online Retail Doing so Explosively Well During the 2017 Holidays?

According to Deloitte, the surge in holiday spending can be largely credited to the mass exodus from physical shopping experiences in brick-and-mortar stores to online and mobile digital experiences. From browsing for products online and paying through mobile/online payment services to tracking their purchases and availing holiday discount offers, shoppers have largely moved their shopping journey to their mobile devices and laptops.

Therefore, retail stores that offered digital services like Amazon, Walmart and Target saw their sales skyrocket during the holidays; meanwhile, brick-and-mortar retailers like Sears and Macy’s have seen their revenue take a cut from the impact of the rise of eCommerce.

With that said, let’s see how the holidays impacted some of the top online retailers in 2017.

Amazon Continues to Dominate the Online Spending Game

Despite the rising competition from other retail giants like Walmart and Best Buy Co., Amazon continued its dominance during the holiday season. The Seattle-based online retail giant captured nearly 90% of the online holiday spend; showing a very little difference from last year. Its closest competitors, Walmart and Best Buy scored 4% of the spend, while Target grabbed the remaining 2%.

This trend is likely to shift as more brick-and-mortar retailers wise up to the game, and begin offering their products online; but for now, Amazon’s dominance is well-established. Furthermore, Amazon’s Prime Members are accounting for a huge chunk of the company’s revenue, with most members spending up to $1,300 on average per year.

Walmart Is Becoming a Force to Reckon With

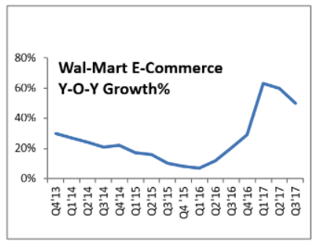

Although it’s still far behind in the market stakes, Walmart has been slowly upping its game ever since it purchased the eCommerce start-up, Jet.com for $3 Billion in 2016. The purchase kicked Walmart’s eCommerce stakes up a notch, even as it continued to play catch-up with Amazon.

The company saw a significant rise in its sales, with gains over 50-60% being driven by organic sales through online purchases. Furthermore, it expanded its online product catalog, introduced two-day free shipping options, and pick-up discounts for some of its products. These moves have proved to be largely profitable for the company.

Source: Nasdaq

In 2018, Walmart hopes to project itself as an alternative to Amazon, with plans to generate as much as $4.46 per share in fiscal earnings. While Walmart’s big eCommerce move has been largely good for the company, it still remains to be seen how well it will fare against Amazon’s dominance. However, if its current run is any indication, it is apparent that Amazon may soon have a worthy competitor to contend with.

eBay Cuts its Teeth on IoT and Smart Home Gadgets

In its “Top Shopped” report for 2017, the auction giant eBay reported that when it came to tech trends in online shopping, sales for the Internet of Things and smart home gadgets are at an all-time high. Nest, the brand of wi-fi enabled thermostats, home security systems and other IoT devices, recorded over 211,000 sales, while Roomba, the automated vacuum cleaner sold over 58,000 units.

Likewise, the Home Mini, Google’s answer to Amazon’s echo, which hit shelves in October, posted an average sale of 240 units per month on eBay. Unsurprisingly, however, smartphones continued to dominate tech sales, with one phone sale being made every 5 seconds.

Source: PR Newswire

Looking to the Future: Anticipating Holiday Trends for 2018

Considering that 2017 was the biggest year in terms of online shopping during the holidays, here are a few considerations that retailers can take with them for the holidays in 2018:

- Multi-channel shopping experiences will be paramount. The fact both online and in-store retail sales were up from last year indicates that consumer browsing and purchasing habits are spread across multiple channels - both online and in-store. Therefore, in the coming year, major retail brands are bound to capitalize on it by providing seamless retail experiences across multiple channels: from mobile apps to desktop websites and social shopping, as well. And if selling on multiple marketplaces and shopping carts is somthing you do, it's a great idea to deploy a multi channel selling software.

- Brick-and-mortar stores will seek to level the playing field. According to the report on the Future of Retail in 2018 from the Business Insider (which you can download here), in-store retail will still outperform online shopping in terms of sales generated, however, e-commerce sales will grow at 4x times the rate of retail sales. Therefore, brick-and-mortar stores will need to level the playing field by providing competitive pricing and excellent shopping experiences, like Walmart and Target did.

- Mobile app and mobile web retail shopping trends can no longer be ignored. According to the Business Insider, 51% of shoppers currently rely on mobile apps for their entire shopping experience. Furthermore, according to Stripe: while mobile websites accounted for nearly 70% of traffic, only 15% of them account for successful conversions. Nearly 60% of abandoned shopping carts came from mobile purchases, primarily because of poor load times, poor mobile web experiences and poor re-engagement strategies. But, this trend may soon see an uptick, if retailers streamline and improve usability in their apps.

- Black November instead of Black Friday According to the National Retail Federation, 40% of shoppers began their holiday shopping close to Halloween, instead of the weeks leading to Thanksgiving and Black Friday. Therefore, retailers are now offering “Black Friday” deals as early as in the beginning of November, going all the way to last week of December. All the major retailers jumped on this bandwagon in 2017. For example, Amazon offered special new deals every five minutes from early November to December 22nd, with the best offers coming in between Thanksgiving and Cyber Monday. Walmart provided five-day free shipping and discounts to all its shoppers, not just premium ones. Likewise, Target held nation-wide toy demos, free hot chocolate and in-house experiences to its customers.